I’m finishing up this post at a “Crypto Cafe” I stumbled upon here in Medellin. It’s going to be my office for the next week since they accept crypto for payment—always a bonus while I sort out opening an account with a crypto-friendly bank (currently in progress).

Off-boarding crypto into fiat remains an expensive and clunky process, so whenever the chance to spend directly in crypto comes up it’s best to take it.

I’ve only been in Medellin for a few days now, having just come from Asunción, Paraguay, where I spent the last few weeks. I’ll cover more on this in my next post which will be an update on my travels plus a 6 month review since I left NZ.

Brief Recap on DePin

This post is a follow-up to my DePin Part 1, where I explained what DePin is and why I’m bullish on this sector within crypto. If you haven’t read it yet, I recommend checking it out for context. In that post, I focused on General Compute DePins, as they’re seeing the highest demand right now, fueled by the rapid growth of AI. I also shared the three General Compute projects I invested in, one of which (NOSANA) is now up 135% since then so congrats to anyone who jumped in on that as well!

Unlocking supply in DePin protocols is relatively easy, but attracting demand is the key challenge. So my approach has been to either;

A) Gain exposure to several projects where I anticipate heavy demand (as I did with General Compute), or

B) Find individual projects that are significantly superior to its traditional competitors.

I believe GEODNET falls into the latter category, and in this post, I’ll explain why.

Quick reminder: I’m just sharing what I’m doing, not providing investment advice.

What Is GeodNet and How Does It Work?

GeodNet is a location services protocol that offers a highly accurate global GPS system. It can improve the accuracy of GPS by up to 100x and, for some clients, provide services at costs up to 20x cheaper.

Traditional Global Navigation Satellite Systems (GNSS), like GPS, rely on a network of satellites orbiting the Earth. These satellites constantly transmit signals to devices on the ground (like smartphones, car navigation systems, or fitness trackers) to calculate their position. However, GPS accuracy is typically limited to within a one-meter radius due to factors like atmospheric conditions or slight inaccuracies in satellite positioning. You’ve probably experienced this when your GPS "wanders" while using maps or apps like Uber.

For many applications, this level of precision is acceptable. But in fields such as autonomous driving, drones, and surveying, precision and consistency are critical. That’s where Real-Time Kinematic (RTK) technology comes into play. RTK networks significantly improve GNSS accuracy, reducing the margin of error down to centimeter or millimeter precision by using ground-based stations to correct GPS signal errors.

In the case of GeodNet, these ground-based stations are run by “miners.” Anyone with a stable internet connection and a roof with a clear sky view can set up one of these miners and earn rewards in GeodNet’s native tokens. The miners "harvest" high-accuracy GNSS data from satellites and transmit it to the GeodNet network.

Here’s how it works:

Supply: High-precision GNSS data, "mined" from satellites by the network’s base stations.

Demand: Companies that require highly accurate GNSS data, typically subscribing to the network’s services.

GeodNet essentially sells location data with unprecedented accuracy, and the network rewards miners for providing the infrastructure to support this data collection.

So Where Does Blockchain Come In?

Building out a global infrastructure for a network like GeodNet in the traditional sense (i.e., through a centralized company) would require immense resources. Global coverage is key, meaning base stations need to be set up worldwide, which would be both costly and time-consuming. For large-scale networks like 5G, that investment can be justified, but for a smaller niche like GNSS, the economics don't make as much sense. That’s why hardly any commercial companies have tackled it.

There is one big player called Trimble (TRMB), which took over two decades of consistent investment and technological innovation to achieve its current level of global coverage of 5,000 base stations.

By comparison, GeodNet launched in 2022, and as of today, it already has 10,116 base stations, double what Trimble achieved but in just a fraction of the time.

Blockchain technology has made this possible. Anyone with an internet connection and a rooftop can purchase a miner (currently priced at $700) and participate in the network. These miners earn upto 24 GEOD tokens per day. At the current token price of $0.23, that translates to $5.50 per day or $2,014 per year.

This means a miner can 2.8x their initial investment within the first year. Pretty solid, and by design to bootstrap the network quickly.

This rapid expansion and economic model wouldn’t be feasible without blockchain. Imagine trying to distribute $11 a day to thousands of miners across the globe using traditional financial systems, it would be too expensive and inefficient.

Additionally, blockchain provides a safer and more secure way to transmit data since it operates on an immutable ledger. This is crucial given the importance of the GNSS data being collected and used for high-precision applications.

So, GeodNet is building out its infrastructure with virtually no upfront capital investment. Instead, it shares revenue by rewarding miners in the form of GEOD tokens. Miners can hold the tokens to benefit from the network’s growth or sell them for USD.

The Tokenomics

One of the key factors I look for in DePin projects is how value is derived for the token, beyond just being used for utility on the network. In other words, the token should play a crucial role in capturing and growing value, not just facilitating transactions. Since this technology is still new, these token models are experimental, however GeodNet has the best models I've seen so far.

To use GeodNet’s services, clients are required to pay in GEOD tokens. When a transaction is initiated, 80% of the GEOD tokens used are burned—meaning they are permanently removed from circulation. The remaining 20% goes to the GeodNet foundation to cover Opex.

Because the burned tokens can never be re-issued, this mechanism effectively reduces the total supply of GEOD over time, creating a deflationary effect. As demand for GeodNet’s services grows, the token supply decreases, theoretically driving up the value of each remaining token.

This design is far superior to the traditional share buyback model in equities. There is no equity component with GeodNet so the tokenomics directly tie the network’s growth and usage to the value of the GEOD token, aligning incentives between network users and token holders.

Miners Rewards

A number of metrics determine a miner’s reward, based on the quality of the data provided and the location of the base station. There are attractive “first mover bonuses” for being the first miner to set up in key locations where the network needs coverage (another mechanism to help the network scale quickly). Additionally, rewards are halved every 12 months, reducing by 50% to ensure sustainable growth.

The total supply of GEOD tokens from inception was 1 billion and they were allocated accordingly.

The market cap at the time of writing is $45,000,000 with a fully diluted value (FDV) of $226,000,000

One slight concern from an investment perspective is that only 20% of tokens are currently in circulation, with approximately 60% held by the team, investors, and the ecosystem. While these tokens are undergoing a multi-year unlocking process, there are no further details available on the exact schedule. Typically, with projects like this, you can track token unlock dates to predict when large amounts of supply might hit the market.

This creates the potential for a significant supply increase once early investors and the team start selling. However, this isn’t unusual in crypto projects, and I’m confident this will be handled appropriately. After all, it’s in no one’s interest (especially the team’s) to crash the price by unloading tokens all at once.

It’s also worth noting that lead investors are hardly in profit at the current token price. This is rare for a project with such strong adoption, as it’s common for early investors to be up by 1000% or more in similar cases.

The fact that we're able to invest at prices similar to the lead investors is a promising sign.

The Market for GNSS

GeodNet serves a variety of industries that rely on precise location data, including precision farming, advanced surveying, construction, urban planning, mapping, and navigation. For example, John Deere’s AutoTrac system upgrades existing tractors to allow for self-driving, reducing waste, improving yields, and increasing energy efficiency.

Historically, only large farming organizations could afford this level of precision, but with GeodNet's significant cost savings compared to competitors, smaller organizations are now beginning to adopt the technology.

One interesting product benefiting from GeodNet’s services is robotic lawnmowers. With GeodNet’s high-fidelity location services, these devices can perform tasks faster and with less wasted energy, demonstrating the wide range of applications for GeodNet’s technology.

The GeodNet team is actively building the demand side of their network, continuously signing new partnerships and clients.

There are also growing opportunities in sectors such as aerospace/aviation, logistics, geoscience, and telecommunications.

GeodNet also wholesales its high-precision GNSS data to semiconductor companies that manufacture GPS chips.

Emerging industries, such as augmented reality (AR), are also beginning to require accurate GNSS data. For example, AR games like Pokémon Go depend on precise location services, and this demand is likely to increase as AR technologies evolve.

GeodNet currently has over 30 business partnerships. The team has faced criticism for not being as involved in the crypto industry, which is why the project has flown under the radar for many investors because they’ve spent the last two years focused on building these partnerships and securing demand. Now, they are starting to enter the crypto space more actively, attending industry events like Token 2049 and are therefore starting to gain attention.

Investment Proposition Summary

As I discussed in my post on Crypto Trading & Bullish Sectors, the factors I consider when evaluating a project are:

Competitors & Point of Difference

GeodNet faces virtually no Web3 competitors in the GNSS space. Unlike sectors like compute, where competition is fierce, GNSS mapping remains a niche market. Among traditional Web2 competitors, the closest comparison is Trimble, which I mentioned earlier. They have a market cap of $15 billion, although it is a different enterprise in many respects but its principal component is the monetization of geospatial data.

GeodNet (FDV of $226m) has twice the amount of base stations and growing at a much faster pace. This suggests that GeodNet likely has more extensive coverage and is significantly more cost-effective.

Token utility & supply dynamics

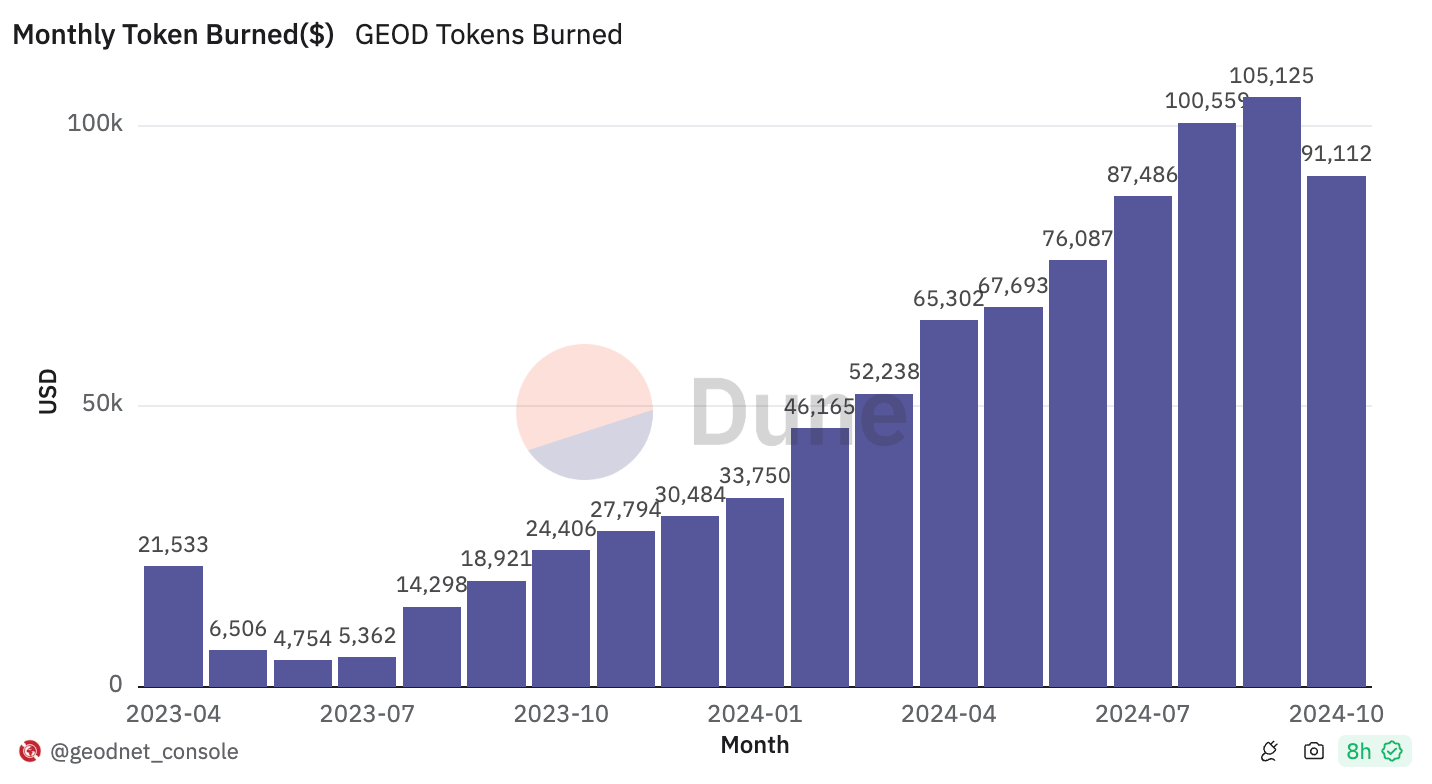

I covered thi above however I will highlight the token burn rate below.

Active users & growth

The number of miners on the GeodNet network is growing rapidly, and the burn rate of tokens is also increasing, which is a strong indicator of rising demand. Additionally, some of the recent partnerships are only just beginning to monetize, suggesting this growth trajectory should continue as these partnerships fully activate.

Team, developers, partners, & community

GeodNet boasts over 30 business partnerships and an A-class team, which you can explore in more detail here. A standout figure is the project creator, Mike Thornton, who has over 20 years of experience in the aviation industry. He previously founded a sensor network company, which he successfully sold for $50 million in 2011.

As the project gains traction, the community is starting to take shape, reflecting the early stages of what could become a vibrant ecosystem as GeodNet continues to grow.

Product Market Fit, industry disruption & potential

The real-time kinematics (RTK) market is currently valued at around $3.4 billion. GeodNet’s significant cost savings position it well for disruption within the existing market and also offer the potential to open up entirely new markets. Such as the AR/VR applications I mentioned earlier.

GeodNet has the advantage of being a first mover in the crypto space, and the rapid expansion of its network provides a moat against potential crypto competitors that may try to enter this sector.

How I’m Positioned

I first invested in GeodNet at the beginning of the year with a small position after my friend Harry Ferguson who put this on my radar. His knowledge of blockchain technology is well beyond mine and he has a very fundamental approach to investing in the space.

Since then, I’ve increased my position around current prices, bringing it to a 5.5% weighting in my portfolio.

I’m planning to time the liquidity cycle and exit most of my positions around mid to late next year, while continuing to hold a significant portion of Bitcoin and Solana. However, GeodNet is the first project I plan to maintain a position in with a 5 year outlook.

Although the majority of crypto tends to trade in tandem, I believe that we will finally see some projects de-correlate from the broader market due to their strong fundamentals and I’m betting that GeodNet will be one of those assuming the sustained growth and usage.

If you made it this far, thanks for reading! If you found this post valuable, please share it with others who might enjoy.