The number one thing that the internet did to society is revolutionize communication and access to information.

Thanks to the internet, with enough effort, we can practically learn whatever we want to learn and therefore, do and be whatever we want to be. There are “how to” manuals and videos on pretty much everything.

As I covered in my last post, I’ve chosen to spend my time and energy learning about finance, crypto and trading. You can only imagine how many finance, crypto and trading “guru’s” there are all over the internet - some with different agendas to others. I’ve been in what I’d call the online retail crypto & finance space for 8 years now and I have seen the good, the bad and the ugly.

My learning journey started with Youtube, followed by free newsletters and publications and then eventually paid subscriptions and courses. Those who I follow and the content I choose to consume will play a huge factor in shaping me as a trader and investor as these people will essentially be my teachers and mentors in this space.

Fortunately, I’ve spent a bit of time in this space so after a while you get a good idea of peoples character and performance. However, I am conscious that I am consuming this content through a screen and that 8 years is still a tiny sample size in the grand scheme of things so I remind myself to maintain a level of skepticism and scrutinize certain ideas and theories.

Looking back over the last 8 years most of those who I followed or learnt from to begin with have a fairly poor track record. Especially in crypto, there is a lot of shit content that you need to filter through. The same goes for trading. The first trading course I paid for was $3,000 and it was crap. You get something from everything but the strategies that were covered in this were so old, dated and basic. I now think the guy is probably a break even trader at best. However, he is an incredible marketer and my bet is that his money is made from the courses he sells and not trading.

That’s just one example of many. X (formerly Twitter) is the worst for it. There are accounts that have hundreds of thousands of followers that have poor performance. They are very clever the way they distribute their content and for a new person in the space, it would seem that they are winning.

But, after filtering through the crap over the years, I believe I have found some of the best people in the space, or at least the best from those who choose to share their views online through content.

The best crypto trader I have come across is an Australian dude that goes by Trader Daxx. The the best macro economist is Raul Pal, founder of Real Vision and former Goldman Sachs executive. Special mentions also go to Tony Greer who is an incredible momentum trader and Jarrod Dillian who is the sentiment guy.

My opinion of “the best” is based on their public calls they have made and how things have played out to date. I also think I am a good judge of character and they seem like very genuine people although I have never met them in person.

In this post, I’m going to cover my macro outlook that comes from Raul Pals thesis that he has called The Everything Code.

In my last post, I talked about my journey into trading which is a very broad term as there are many different types of trading. One thing that is evident is that the best trades are those that are done on higher time frames like months and years, compared to days and weeks.

I run a shorter term trading strategy (days & weeks) as well as a longer term strategy (months & years) which I call my HOLDING portfolio. Right now, I have 80% of my liquid net worth (not including property) in the HOLDING portfolio which is 95% crypto. This is because of the point of where we are in the liquidity cycle which I’ll elaborate on below.

The Holding Strategy is similar to an INVESTORS strategy where you’re in positions for a longer period and therefore riding the volatility. In order to ride the volatility you need a very high conviction in your bets to ensure that you don’t get shaken out. In order to have a high conviction you need a good level of understanding.

So the goal of this post is to show you why I am so bullish on the crypto market. It’s going to be less about the technology which I’ll save for a future post but more about the underlying factors that are driving ALL MARKETS - the macro framework.

The Everything Code

Raul Pal has published multiple videos and reports online so if you want to know more after reading this post, hit me up and I’ll send you some links for a far more comprehensive breakdown. They are 2 hours + long so I will provide a summarized shorter version of my understanding of it. There are a lot of things that I won’t cover here so I strongly recommend taking a look.

Essentially, the thesis is that there is no way the global central banks and governments can deal with the current level of global debt without monetizing it and debasing the currency.

Monetizing debt refers to a process in which a central bank or government converts debt (typically government bonds) into money supply. The central bank simply creates new money then purchases government bonds, injecting cash into the financial system and increasing the money supply. Simply put, it’s TRANSLATING DEBT INTO MONEY SUPPLY and therefore, DEBASING THE CURRENCY.

Governments and Central banks have been debasing currency for hundreds of years. Back in the day, it was shaving small amounts off gold coins. Today, it’s more creative methods under the fiat money system we are in.

Fiat money is a type of currency that is declared legal tender by a government but has no intrinsic value or backing by a physical commodity, such as gold or silver. The type of money that we use today.

So currency has always been debased but in 2008 after the Global Financial Crisis (GFC) it was taken to an entirely new level and it’s only gotten worse since, with unprecedented amounts of money created in 2020 after Covid.

It has always been observable that after these events, when a whole lot of new money supply enters the system, asset prices go up. However, what Raul discovered in his deep dive, is that most asset classes aren't actually going up in Real Terms, it’s just the denominator (USD, NZD or any other Fiat currency) that is going down in value.

So rather than measuring the asset classes against a currency, measure them against the combined balance sheets of the largest central banks in the world and you will get a better representation of how that asset class has performed in real terms. Or see this example (since I have these charts on hand from a recent report), the USA asset classes divided by US’s Federal Reserves balance sheet.

and then there is Bitcoin…

The charts are pretty much the same when measured against the global money supply. They show us that all asset classes outside of technology stocks and crypto are hardly going up in value, they’re mostly just holding their values in real terms.

This is all because of currency debasement and to understand why this will likely continue for the foreseeable future (3 - 5 years) we first need to understand the driving forces behind it and consider what other options Governments and Central banks have.

The GFC

From the 1980’s onwards, governments, central banks and the private sector took on huge amounts of debt until the Debt to GDP ratio was at 100% for most countries and even more for households and corporations in the private sector.

GDP Growth is what drives savings and investment but it is also what pays the interest on the debt.

The GDP rate refers to the total monetary value of all goods and services produced in a country during a specific period, while the GDP GROWTH rate measures the percentage increase or decrease in this value compared to a previous period.

By the early 2000’s GDP GROWTH had fallen to about 2% and interest rates were close to 6%. So if GDP growth is what pays the interest on the debt but the interest rate is almost 3 times of that, it’s not possible and the system breaks… well almost.

To avoid a complete collapse, central banks globally dropped interest rates to near zero followed by the implementation of quantitative easing (QE).

Quantitative easing is when the Central Bank prints money to purchase assets from the private sector (banks and financial institutions) to boost reserves and stimulate the economy. It’s used in times of economic downturn. This is different to Debt Monetization which is where Central Banks print money to buy government debt to finance government spending. Both directly increase the money supply.

It worked. The system was saved and this has now become the playbook for central banks and governments since.

However, they did not pay off or reduce that debt. They refinanced it for another 3 to 5 years. Consequently, every 3 to 5 years when the principal on that debt matures, governments refinance it all while covering the interest payments by monetizing it (translating it to money supply). Hence the saying “kicking the can down the road”.

So all of that debt that was refinanced and created in 2020 on very low interest rates is in the process of being refinanced on current interest rates. This is why the interest on the US government debt has now surpassed other expenses like defense for the first time in history.

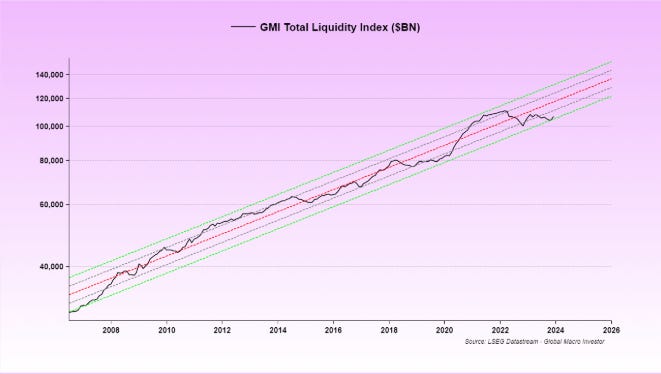

This interest is paid through debt monetization (translating to money supply) which is the main component in global liquidity which contributes to the fairly predictable cycle and the secular uptrend.

Global liquidity refers to the availability of liquid assets. The key components that drive it are money supply/creation, credit availability (interest rates and lending appetite), market liquidity (number of buyers and sellers), and cross border capital flows (movement of money for the purpose of investment).

What other options do they have? How can governments reduce the debt and how can they manage it without monetizing it?

To pay the interest on the debt, the GROWTH rate of GDP needs to be higher than the interest rates on that debt.

The GDP growth rate is currently 1.5%, so either interest rates need to drop below this level (increasing global liquidity) or the GDP Growth Rate needs to improve significantly. The three large factors that determine GDP growth are demographics, productivity and debt.

Demographics is the number one factor of the three and it is the big secular issue that society is facing right now because of the slowdown in population growth with the trend only getting worse (especially for the west).

A reduction in population growth is bad for GDP because you have more people leaving the labor force than entering it which reduces productivity, reduced consumer spending (reduction in demand) and a strain on social welfare systems (increase in dependencies).

With this major headwind, society is in need of a productivity miracle. Despite all the inventions in the 20th century such as the internet, computers, and mobile phones, there hasn’t been a productivity increase per capita.

I think AI and robotics will be different and it probably will be the answer but how long will it take until it starts to make a material positive impact to global GDP growth? I should emphasize the word miracle, because it’s a significant increase that’s required.

So until then, I believe they only have three options. Raise taxes significantly to increase the government’s income, make huge cuts to government spending and reduce the expenses until there is surplus or continue to monetize the debt (debase the currency).

Taxes are a political decision and in this hugely polarized world, no one can afford to lose votes, so both parties just allow the central bank to debase instead and pretend it is a monetary decision as opposed to a political one. For example, it is easier to debase the currency by 15% per annum than raise taxes by 15% although the result is the same. People are poorer but the difference is that they don’t understand why.

Making material decreases to governments spending is easier said than done. It would mean moving the pension age from 60 to 65+, cutting defense in a geo politically unstable world, or taking away healthcare. No politician is going to get elected on such policies unless things were so bad for the population that they’re prepared to take such extreme measures.

This is what we’re seeing in Argentina right now with the recent appointment of Javier Milei. A libertarian who is all about the free market and actually campaigned on massive government cuts and has since acted on them. He was upfront about this process being short term pain for long term gain. They’re witnessing the short term pain right now and will be very interested to see if they achieve the long term gain. If achieved, it should be recognized globally and could potentially set a precedent for policy and leadership.

This is a global issue, not just the USA.

As outlined above, until there is a productivity miracle there is a very high probability that global governments and central banks will choose the easy option and continue to debase their currencies. I used the USA in most of the examples because it’s the largest market by far and the USD is the world reserve currency.

Therefore, what the federal reserve and US government do has a material impact on the rest of the world. Certain countries have been desperate to drop interest rates or perform QE to stimulate their economies but they can’t due to risk of their currency collapsing against the USD. Over 60% of the world’s debt is denominated in USD so if that were to happen, countries would go broke.

What determines the strength of one’s currency when measured against another country is not just the supply, but factors such as political stability, debt levels, inflation rates and foreign reserves.

For example, the main reason why Japan has been able to print ludicrous amounts of money through Yield Curve control while maintaining the Yens value against other currencies is because they have very strong foreign reserves.

The likes of India, China and Brazil and other global super powers have been buying record amounts of gold, silver and other hard assets to boost their foreign reserves which will enable them to print even more money than what they have done historically while maintaining their value against other currencies.

Note that I am stating against OTHER CURRENCIES because as highlighted in this post, they’re all losing strength to ASSETS.

So why crypto?

Since 2008, the money supply (from the 4 largest central banks) has increased on average 10% per annum and inflation has averaged 2.5% depending on what country you are in.

Inflation is when the price of goods and services increase whereas currency debasement is when the intrinsic value of the currency decreases. Both result in a loss of purchasing power.

This means for someone who does not own any assets they are becoming 12.5% poorer each year as their purchasing power decreases. When someone buys an asset it is future deferred consumption. You buy assets with the expectation of them to increase in value so when you sell them in future, you are in a better financial position with more purchasing power.

However, if your asset is not increasing in value by more than 12.5% p/a then you aren’t actually getting ahead. As outlined at the beginning of this post, it’s only technology stocks and crypto that are the “sectors” that are beating this benchmark.

Similar to a horse race or sports game, the favorite is determined by their past performance. So Technology Stocks and Crypto are the favorite to continue but let’s look at what’s different now to then.

In terms of technology, it’s the answer to the productivity miracle so I think AI and Robotics will present some great opportunities. I’m a complete newbie to the space but plan on learning more which I’ll share in future.

Crypto, is a technology stack that is a layer of the internet that creates digital scarcity. What is magic about it all is that we can own a part of it. It’s the only asset class that allows the retail investor to get in before the institutional investors. Unlike traditional tech where most of retail is only able to invest once the company has become public and where most of the gains have already been made.

Bitcoin is generally peoples on ramp to crypto with it being the easiest to understand. When you learn more about the technology and how it came about you begin to understand that unlike the rest of the crypto space, Bitcoin has almost no competitors and is by far the safest bet. It’s where money flows first and then like all markets, once money comes in and it appreciates, it then flows down the risk curve and into alternative coins (alt coins).

What is incredible is that up until the last bull market (2020 & 2021) it was only retail in the space. Some hedge funds and institutions got involved from 2019 but due to the lack of regulation the real money could not enter.

Today, Bitcoin is now recognized globally as a legitimate asset and even conservative pension funds are doing interviews about allocating 0.1% to their portfolios and are expecting to get up to 1% to 2% allocations over time.

Eleven Bitcoin spot ETFs went live in the US, and became the most successful ETF launch in history by a wide margin. ETFs are now being launched in most countries including Hong Kong (access for China). Money from sovereign wealth funds is on its way, even mere 1% to 2% allocations should move the price considerably.

Below is a chart of the gold price and what happened after an ETF went live.

The next biggest protocols are Ethereum (ETH) and Solana (SOL) which are smart contract platforms and referred to as “Layer One” blockchains. They’re competing with each other (along with many others) to be the main infrastructure layer. The protocols adoption will depend on how many applications are built on them. Think of Apple and Android as the infrastructure (like ETH & SOL) and then the applications in the app stores as what’s being built on it.

Bitcoin, Ethereum and Solana are the only three protocols that have gained proper network affects therefore, in my opinion, they provide the best risk to return bet for any non crypto person that wants to invest in the space and isn’t prepared to go digging through the weeds.

A network effect occurs when the value of a product or service increases as more people use it. This phenomenon is common in technology and communication platforms, where each new user adds value to the network for existing users. For example, Instagram became more valuable as more users joined and shared content, making the platform more engaging for everyone.

Network effects happen in crypto because they enhance trust, utility, liquidity, and security of the protocol. Increased adoption leads to greater value and usability, attracting even more users and participants creating this positive feedback loop.

The price action and speculation is what gets most of the news headlines but the actual technology will have a hugely positive impact on society. Blockchain will enhance transparency, it will decentralize trust, it will enable financial services to the unbanked, it will remove the need for intermediaries and it will unlock liquidity to real world assets.

Just as the internet revolutionized the way information is transferred, shared, and accessed globally, blockchain will revolutionize the way value is transferred, managed, and secured.

I believe it presents the best investment opportunity of our lifetime and it’s still so early in its adoption.

12 - 18 month outlook

Prices move fast in crypto and the majority of the gains are made in short periods of time. So if you have made this far I will finish with some charts that paint a pretty positive outlook in the next 12 to 18 months.

GMI financial conditions index leads Global M2 by 4 months. If the correlation remains we should expect in increase in the global money supply in the coming months.

The average of Bitcoins performance in past presidential election years. Run up in price from May to August, then sideways action until November, before running up again.

Bitcoins macro overbought & oversold indictor suggests that real rally hasn’t even started yet.

The ISM is the best representation of the business cycle and it’s grinding higher. This is a correlation with alt coins, similar to small cap stocks. As soon as the business cycle improves, retail gets money, and they start punting.

Fed Net Liquidity with a 12 month lead on altcoins as a % of BTC’s total market cap. This shows that altcoins should start outperforming Bitcoin over the next 12 months.

This chart shows Bitcoins volatility and what happened to price the last 6 times it touched the 20% line.

Same goes for Solana…

Thanks for reading and I hope you got something from it. Hit me up if you have any questions or would like me to elaborate on anything.

💪📈 Nice read bro!!