My 2024 Recap and 2025 Plans

My travels, what’s next, end-of-year portfolio review, and the macro landscape and state of the crypto market heading into 2025.

2024 Travels & Where To Next

December Snapshot & E.O.Y Review

The Macro Landscape & 2025 Outlook

The State Of Crypto

I left New Zealand in April 2024 to trade financial markets while traveling the world. I’m no expert but am working towards becoming one. Crypto is where I’m investing the majority of time, energy and capital. It’s a wild industry that I think is a generational investment opportunity.

I started this Substack after being inspired by a like-minded bloke who documented his journey of ditching the rat race in Australia for South America to trade commodities and resources.

I write about my travels, my portfolio, my trades and where I see the best opportunities in crypto with the objective of making it digestible for a non crypto person looking to learn. Nothing I write is financial advice, I’m simply sharing my journey, thoughts, and trades.

2024 Travels & Where To Next

2024 was epic. Since leaving NZ in April I’ve been to 9 countries, made loads of new friends, caught up with a load of old friends and got a mrs.

January - April

My final months in New Zealand, enjoying summer, catching up with friends and family before departing.

May

I spent a month travelling around Thailand with my little brother, cousins and good mate from NZ. Starting in Bangkok, Chiang Mai, Pai, Ko Phan-gan and Koh Tao.

June

Back into a routine, based on Fitness Street in Phuket with a good mate visiting from England.

July - August

Two months in Bali with visits from old mates from NZ. Meeting loads of interesting people, new friends, and a bird from Singapore.

September - October

A short stay in Melbourne with family before heading to Buenos Aires for a month, followed by a month in Asuncion and 2 weeks in Medellin Colombia.

November

A weekend in Madrid followed by a month in Sri Lanka staying between Ahagama and Hirikitia with my girlfriend.

December

A week in Bangkok, followed by 5 days at an electronic music festival, a week decompressing at Hua Hin, Christmas in Ko Phan-gan and New Years in Koh Samui with friends visiting from NZ.

Travel plans for 2025

My friends left Ko Samui a few days ago but I’m sticking around for 3 more weeks on my own. I’ve got some cheap accommodation at a 2 star hotel for $200usd pw. I signed up to a Co-working space mainly to use the large monitor ($65usd pw). I’m 2 minutes from a gym ($25usd pw) and 5 minutes from a Spa/Sauna/Kitchen/Massage spot that costs around $100usd pw.

There is a Meal Prep cafe (healthy food) one block over and I have rented a bike $60usd pw. All up, I’ll spend around $1,800usd for essentially everything I need/want when locking in. I love Thailand.

After Thailand, I’m heading to Singapore with my girlfriend for two weeks celebrating Chinese New Years. This will be a new experience but it sounds right up my ally as there is apparently a lot of gambling.

This is how I’d like to structure my year. 3 weeks locked in, no drinking or partying and then 1 week that’s more relaxed. If I’m left to my own devices I rarely get away from my laptop. Fortunately, my girlfriend always finds activities and places to explore so it’s been great travelling with her and getting me away from the screen.

We’ll be staying in Da Nang, Vietnam, in February—a highlight from my 2019 travels, so I can’t wait to go back.

In late March I’ll pop back to NZ to catch up with friends and family before heading to Bali from April to July. After that it’s most likely Europe, followed by South America.

December Snapshot

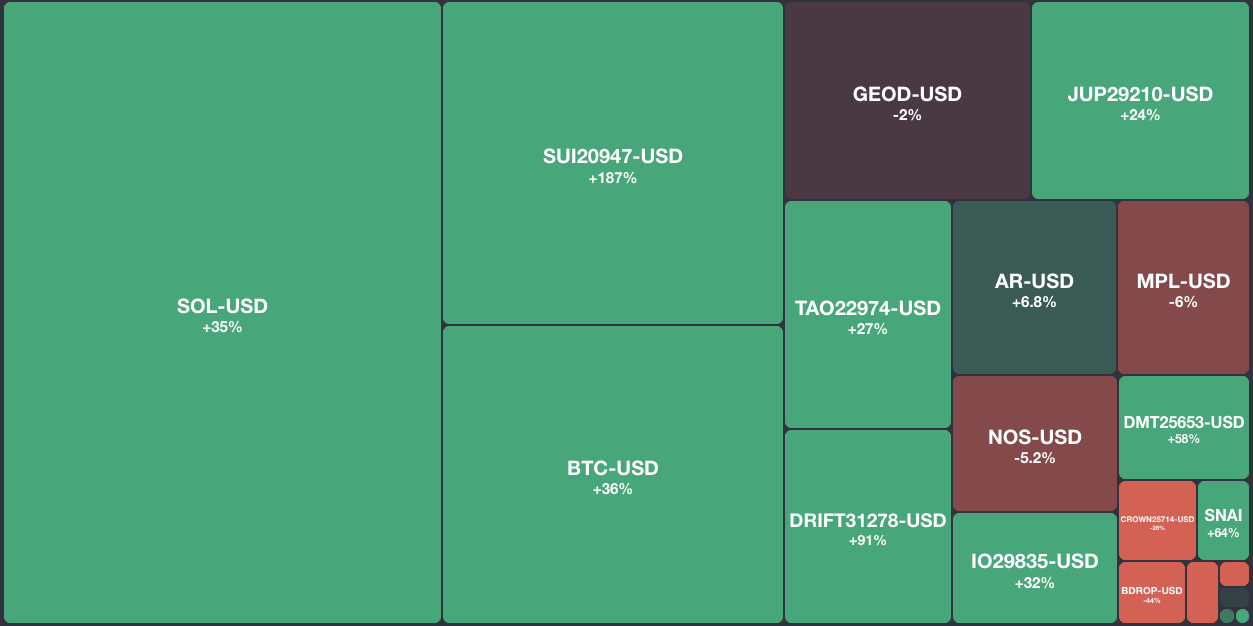

It was a great Q4 for Crypto but as I mentioned in my November post, it started to get frothy and sure enough, we’ve now seen the pullback I anticipated.

I closed out several leveraged long positions in early December, locking in gains from positions I’d held for months, which softened the blow. But I was still heavily long overall, so even after taking those profits, my total P&L for the month still dropped 13% ($54k USD).

Even though I accurately forecasted the sell-off, I should have been bolder and taken more off the table.

End Of Year Review

I’m pleased with my performance in 2024 and heading into 2025 feeling confident and therefore cautious.

I execute trades/investment using two strategies: HOLDING and TRADING.

Simply put, the difference comes down to timeframe. HOLDING includes my core bets that I hold for longer periods, while TRADING is more tactical, with shorter-term targets. Every position I enter is categorized and tracked under one of these strategies.

Combined, I finished the year up 96%—a $208,000 USD gain. My TRADING strategy delivered a $43,000 profit, while $165,000 is from my HOLDING.

Most of the gains from my HOLDING strategy are unrealized, and it goes without saying that I ride some wild volatility—December was no exception.

I have a much smaller allocation to stocks, which I track separately from crypto. I finished the year up 18%, equating to $5,100 USD in paper profits (unrealized).

Highlights & Lessons

HOLDING

Buying SUI near the lows and adding to the position as it climbed has been my best trade in terms of ROI and it’s held up very well in the recent sell off and now makes up 13% of portfolio.

Solana has delivered the largest portfolio gains due to a larger position size.

My two biggest takeaways: hold fewer positions with larger sizes in my core bets, and trust myself more by taking bolder actions—both when buying and selling.

TRADING

I started this in February and am happy with my performance considering how many mistakes I made throughout the year. I’m continuing to develop and refine this strategy. Over-trading was my biggest issue, but I’ve recently implemented a system to help me better assess trade quality and execute only on the best opportunities.

Looking back at some of the trades I took throughout the year, I’m shocked at a few of them. But with what I know now, I’m confident I’ll significantly improve my performance this year.

STONKS

I sold my stocks earlier in the year to fund my travels and re-entered the market in September. I take the same approach to Stock as I do with my Holding Strategy in Crypto.

TSLA has been the standout performer, I’m practically flat on my uranium miners and have made small profits on Bitcoin miners.

I have since sold my Uranium miners to fund an early seed investment in my cousins AI company (more on that in future) and potentially buy another Bitcoin Mining Stock that I am considering.

The Macro Landscape & 2025 Outlook

In my Macro BluePrint article from June, I broke down Raoul Pal’s “Everything Code,”. The TLDR is that all roads lead to currency debasement, meaning asset prices rise against fiat currencies. It’s my favourite post to date so check it out. Or look up Raoul’s content on Real Vision or Youtube.

I share his content all the time with friends and family because so many macro commentators keep calling this the “Everything Bubble” and scaring people away from making meaningful returns.

I think these doom-posters will be right one day—but my money’s on that day being a long way off. Every five years or so, there’s a scare, but the sell-offs are almost always smaller than predicted and tend to rebound quickly. Why? Because the Federal Reserve will do whatever it takes to keep the system from crashing. They step in, print more money, and debase the currency.

So where are we now?

Markets sold off to J. Powell’s speech and the revised dot plot in December, which now only anticipates two rate cuts next year. Fear is back, and the bears are perking up again on X.

I see it differently. The revised dot plot sets low expectations, and I believe two rate cuts are highly unlikely.

It still amazes me how much influence one man’s words can have on markets. It’s just one of many signs of a broken financial system—but I’ll save that rant for another time.

Rates need to come down to make debt financing manageable—not just for the U.S., but for most countries. Higher rates often strengthen the dollar, and since much of the world’s debt is dollar-denominated, it creates serious challenges for weaker economies. Their central banks can’t lower rates without risking significant currency declines. That’s why the world tends to follow the Federal Reserve’s lead.

Take New Zealand, for example. Rates should have come down sooner, and now the country is in a nasty recession.

The Fed’s main fear with dropping rates is reigniting inflation, especially given the resilience of the U.S. economy. However, leading indicators from Real Vision’s Macro Investing Tool (MIT) strongly suggest a growth slowdown in Q1, with unemployment likely ticking up. That should give the Fed enough reason to turn dovish and start cutting rates.

As for the dollar, I believe we’re seeing its final leg higher before an epic decline throughout 2025, which should send global liquidity soaring. Trump needs a weaker dollar for his policy changes to succeed. For more insight, check out Arthur Hayes' recent post, Trump Truth, where he breaks down how he thinks the new administration will approach this.

The Current State Of Crypto

Most asset classes hold their value against currency debasement where is emerging technologies like Crypto outperform debasement because they’re at their early stages of adoption.

The Total Crypto Market Cap finished the year up 1.52 trillion and today sits at a TOTAL MARKET CAP of $3.39 trillion.

The Global Stock Market sits at over $123 trillion, the Gold Market at approximately $11.3 trillion, NVIDIA $3.691 trillion, Apple $3.59 trillion, and Microsoft $3.15 trillion.

Crypto is the infrastructure for a tokenized, global financial system. At its current size, it’s barely scratching the surface of its potential. What’s a fair market cap for the backbone of the future economy?

What I am expecting in 2025

2024 was epic for the Crypto industry, not just because it almost doubled its market cap but because of the milestones achieved to set critical foundations to continue to grow as an industry.

Technological advancements achieved in 2024 will lead to a significant increase of new users in 2025

2024 witnessed significant advancements in Zero Knowledge Proofs which reduce onboarding friction by enhancing privacy, improving security, and streamlining processes like verification, scalability, and cross-chain transfers. These advancements make crypto more user-friendly, accessible, and affordable, especially for new users coming from the Web2 world who are used to intuitive, low-friction digital experiences.

We’ve also seen the crossover of AI and blockchain, presenting new use cases—not just in physical infrastructure, but with AI agents driving on-chain usage. There’s massive excitement about what this sector could deliver in 2025.

Stablecoins continue to gain adoption, and it’s no longer just crypto natives using them. They’re onboarding new users—individuals and businesses alike—thanks to the demand for a digital dollar that’s easily transferred and stored at low cost. I believe 2025 will be the breakout year for consumer finance in crypto.

Regulation will pave the way for Decentralized Finance (DeFi) to become a top-performing sector once again.

DeFi has struggled in recent years, largely due to regulatory uncertainty—something the Trump administration has promised to address. With SEC chair Gary Gensler stepping down, Paul Atkins is expected to take his place, bringing a more accommodating stance toward digital assets.

Last year also saw significant legal milestones, such as the sanctions against the Tornado Cash developer being overturned, setting important precedents for the future.

Corporations, US States, and Nation States Will Be the Largest Bitcoin Buyers

Bitcoin is no longer just a retail asset. The ETF launch was the most successful in history, and I expect the massive inflows to continue throughout 2025—driven by corporations, U.S. states, and even nation-states accumulating Bitcoin.

There are rumors that more smaller nation-states are starting to allocate. If the U.S. moves forward with a Bitcoin strategic reserve, game theory will kick in, and competitors like Russia, China, and Brazil will likely follow suit.

But what’s the probability that it happens? In my opinion, the signs point to it being more likely than not.

Mar-a-Lago is where decisions are made for the future of the US.

All of this, combined with a hugely favorable macro backdrop, has me thinking that 2025 will be an unbelievable year for crypto.

As I mentioned at the start of this post, I’m able to live a pretty good lifestyle while traveling at a relatively low cost—less than what I was spending in Auckland, NZ. The plan is to keep it that way so I can maintain a high allocation in crypto and make the most of this exceptional opportunity.

Next week I’m going to share highest conviction bets for the year and updated Holdings.