Portfolio Positioning for 2025

Market expectations, the best performing sectors, and the tokens I have invested in.

Brief Market Commentary

The Macro Environment & Analysts I Follow

Recent Podcasts & Videos

Bitcoin

Smart Contract Layer Ones

Decentralized Infrastructure (DePin)

AI Crypto

Solana Decentralised Exchanges (DEX’s)

I left New Zealand in April 2024 to trade financial markets while traveling the world. Crypto is where I’m investing the majority of time, energy and capital. It’s a wild industry that I think is a generational investment opportunity.

I started this Substack after being inspired by a like-minded bloke who documented his journey of ditching the rat race in Australia.

I write about my travels, my portfolio, my trades and where I see the best opportunities in crypto with the objective of making it digestible for a non crypto person looking to learn. Nothing I write is financial advice, I’m simply sharing my journey, thoughts, and trades.

Brief Market Commentary

Over the past couple of weeks, I’ve been very active in the market, redeploying the majority of cash I pulled out in early December and again around Christmas.

I’m now 94% deployed, with 6% held in cash in case of any short-term sell-offs.

As I covered in my last post, I remain very bullish on the crypto market this year. Sure, the president of the United States launching a meme coin might be the most obvious top signal in hindsight, but I’m focused on staying objective. It doesn’t change any of the key factors I mentioned previously.

That said, it’s pretty wild, and I’d be lying if I said it doesn’t make me a little nervous. Many pundits are calling the Trump inauguration a "sell-the-news" event, but as I write this, BTC is hitting new highs. I guess we’ll find out in the coming days. That’s why I’m keeping some dry powder on the side.

My bet is that the rally continues through late March, after which I expect another correction. I think this is when the majority of crypto degens—after enduring the rollercoaster of the past 18 months—will sell their bags too early. Only to watch the market experience a very strong Q3 and Q4.

My plan is to gradually scale into cash throughout the year, despite my bullish outlook. I’ve round-tripped two cycles before and don’t plan on doing a third. By the end of the year, I aim to have at least 50% in cash, with the macro environment and charts guiding what I do with the other 50%.

The Macro Environment

I believe my edge comes from being immersed in the crypto market every day. This allows me to spot emerging hot sectors and themes early, adjust my portfolio accordingly, and execute trades using technical analysis.

That said, my process always starts with the macro environment, as it dictates how much risk I’m willing to take. I love macro analysis and over the past few years and have learned a great deal, but I’m realistic—I’m nowhere near the level of experts who’ve been doing this for decades. So when I form a macro outlook, I rely on a group of analysts I think of as my “team.”

While I only manage my own money, I treat this entire endeavor like a business. My “team” of analysts, plays a crucial role in my decision-making process. Each video or report I consume is like them presenting their case to me, the boss, who ultimately presses the buy or sell button. I evaluate their performance—if they’re wrong too often, they’re “fired.” At the same time, I’m always on the lookout for new additions.

Over the past month, I’ve read and watched a lot of 2025 outlooks, and the diversity of opinions has been striking. This is why carefully selecting the right team is critical to my approach.

I’ve mentioned Raoul Pal in this publication a few times; his macro outlook carries the most weight in my decision-making, so I see him as my “Head of Macro.” Other analysts I follow closely include Jordi Visser, Lyn Alden, Luke Gromen, and Arthur Hayes. I also listen to podcasts like The All-In and BG2Pod for insights into technological and political trends.

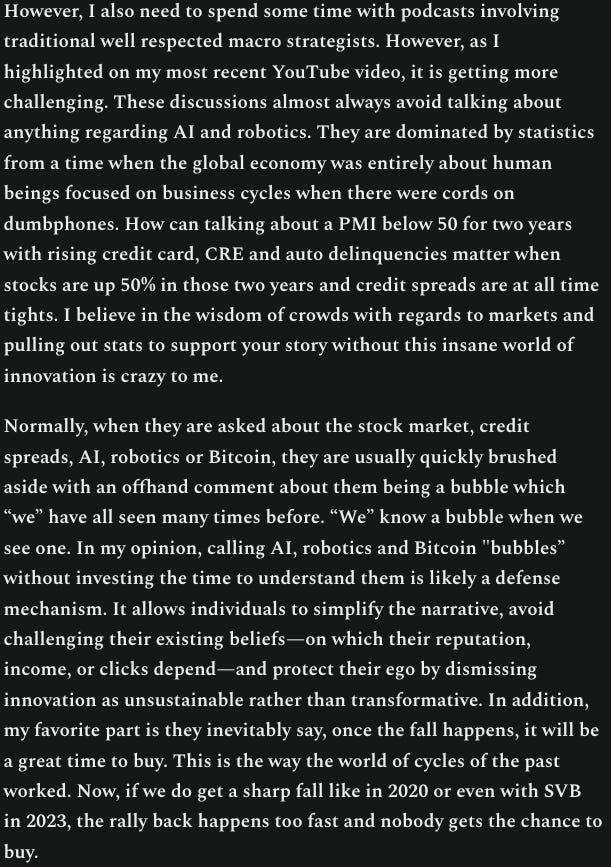

This doesn’t mean I ignore other perspectives—I’m always open to opposing views. However, I’ve noticed that many well-known macro analysts seem to struggle to adapt their frameworks to the new regime we’re in.

Here’s a snippet from Jordi Visser’s Substack that resonated with me:

Before diving into the crypto content, here are a few key reports and videos I recently consumed offering their 2025 outlook.

2025 Predictions: Tech, Business, Media, Politics! - The All In Podcast

Some great insights from incredible minds.

Full Steam Ahead: All Aboard Fiscal Dominance - Lyn Alden

This is an incredible data driven piece explaining how we are in a fiscal dominant environment, in which monetary policy has less of an effect to the economic environment.

Typically, high interest rates should bring down inflation but Lyn explains how high interest rates actually increase inflationary pressures as the interest expense is being paid to bondholders who then re-invest that back into markets & the economy.

Therefore, keeping rates elevated will only exacerbate the fiscal imbalance, increasing interest costs and widening deficits even further.

Today, structural deficits are driven by systemic factors: an aging population requiring higher entitlement spending, rising healthcare costs, and compounding interest payments on decades of accumulated debt.

Asset prices can surge in periods of fiscal dominance, even if consumer prices are stable or even declining.

Life-Changing Money: Ride the Banana Zone w/ Raoul Pal

At times of volatility & uncertainty, Raoul always reminds everyone to calm down & zoom out while giving valuable advice on ignoring the FOMO and sticking to our convictions.

Is the Glass Half Full or Empty for 2025: Expect Surprises, a Regime Shift and Higher Electric Bills

A lot of charts & data and as always with Jordi, a focus on AI’s impact.

Top Performing Sectors & Holdings

Aside from my property, an investment in an AI company, and my Tesla shares, I’m entirely focused on crypto that makes up 70% of my networth. This is the market I’m immersed in daily, and I believe my edge lies in identifying the themes and projects that will outperform.

Here are my predictions for the top-performing sectors and the protocols, projects, and applications I expect to lead the way:

1. Bitcoin

Bitcoin remains the cornerstone of the crypto market, with strong adoption and institutional interest driving its continued success.

2. Smart Contract Layer Ones (Solana & Sui)

These protocols are at the forefront of scalability and innovation, enabling developers to build diverse decentralized applications.

3. Decentralized Infrastructure (DePin)

DePIN projects are creating the backbone for decentralized networks, supporting real-world use cases with scalable, trustless infrastructure.

4. AI Crypto

AI-powered blockchain projects are leveraging decentralized systems for predictive analytics, machine learning, and data monetization.

5. Decentralized Exchanges on Solana

Applications like Solana-based decentralized exchanges are redefining trading with low-cost, high-speed transactions, paving the way for broader DeFi adoption.

Bitcoin

Bitcoin Dominance (BTC’s percentage of the total cryptocurrency market cap) surged in 2024, and while I expect it to drop this year, I don’t think the decline will be as steep as in previous cycles.

The new wave of Bitcoin buyers (corporations and nation-states) appear to be in it for the long term and seem uninterested in assets beyond BTC. However, as money flows into Bitcoin, existing holders will likely realize gains and start moving further out on the risk curve, especially as global liquidity expands.

I will always maintain an allocation to Bitcoin as my own strategic reserve. It’s the safest bet and I think it could one day be the cornerstone of a new economic system.

In terms of how high it can go this year largely depends on whether the US proceed with the BTC Strategic Reserve )BSR). I don’t think it needs the BSR to have a stellar year, but if it did become a reality I anticipate a price north of $200,000.

I only have a 12% allocation to Bitcoin, but also hold two Bitcoin mining stocks, CleanSpark & Cipher Mining that I believe could act as high-beta plays. I’ve started drafting a separate post to dive deeper into these holdings, which I look forward to sharing soon.

Smart Contract Platforms

Holdings = Solana (33%) & Sui (14%)

This is the most competitive sector however my positions are highly concentrated in Solana and Sui. I think it will be a winner takes most and outside of these two projections I’m bearish on the rest of the sector. That’s not to say prices still won’t go up because of speculation and liquidity, but in my view Solana and Sui are miles ahead with innovation & adoption (perhaps with exception of Base, a layer 2 on Ethereum that doesn’t have a token yet).

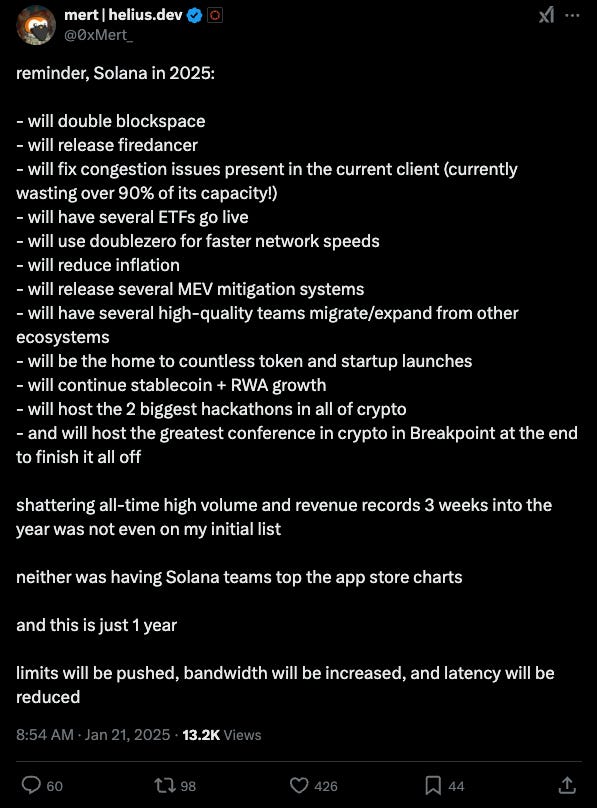

Solana

Since my July post, Solana: My Biggest Bet in the Smart Contract Layer One Blockchain Revolution, the token price has risen 55%, yet the bullish case is arguably stronger.

Solana dominates in on-chain user metrics and its growing users and liquidity are fueling network effects, attracting developers and creating a positive feedback loop.

In comparison to other layer ones it seems very undervalued to me, especially when the Solana foundation continue to upgrade and innovate.

SUI

My next largest position is Sui, which accounts for 14% of my portfolio allocation. Sui is an emerging third-generation layer-one blockchain with significant potential. Unlike Solana, Sui’s market cap currently far exceeds the liquidity and on-chain users. However, this isn’t unusual—price often leads “fundamentals” in crypto, as was the case for Solana and many other projects early on.

That said, there’s a lot on the horizon for Sui that could change this dynamic.

Innovative Features: ZK-Proof Logins

Sui has introduced a groundbreaking zero-knowledge (ZK) proof login feature that could revolutionize blockchain adoption. This feature allows users to log into decentralized apps (dApps) using their Google accounts, bypassing the need to create a wallet as the first step. By combining the convenience of Web2 with the privacy and decentralization of Web3, this tool could simplify onboarding and attract mainstream users. ZK proofs ensure that users maintain full privacy and control over their keys, making it both secure and user-friendly.

This feature is expected to debut in gaming, where seamless onboarding is critical for attracting millions of players. With tools like these, Sui is well-positioned to become a leading blockchain for gaming and beyond.

Phantom Wallet Integration

Phantom Wallet, one of the most user-friendly digital wallets with an average of 7 million monthly users, is in the process of integrating with Sui. This will likely expand Sui’s user base and provide a stamp of approval from one of the most reputable wallets in the crypto space.

Liquidity Growth & Bitcoin Integration

Several upcoming launches are expected to drive substantial liquidity to Sui in the coming quarter. This crypto cycle has reignited efforts to unlock the trillions of dollars in capital siloed within Bitcoin. Any blockchain that secures even a fraction of this capital will benefit from a significant injection of liquidity.

Sui’s Move programming language offers enhanced security, making it an attractive option for Bitcoin liquid staking protocols like Babylon and Lombard, which aim to bridge Bitcoin liquidity. Recently, Sui announced a strategic initiative to bring Bitcoin into its ecosystem.

Another exciting liquidity solution comes from the Ika Network, which enhances the security and scalability of moving assets like BTC, ETH, and SOL into Sui. Unlike traditional bridges that rely on centralized trust, Ika employs a decentralized multi-party computation (MPC) model across thousands of nodes. This approach significantly improves security, opening the door to new opportunities for cross-chain lending, staking, and trading. By enabling a more interconnected and liquid DeFi ecosystem while maintaining speed and security, Sui is setting itself up for long-term success.

Decentralized Infrastructure (DePin)

Holdings: GeodNet (6%), Helium (3%), Nosana (2.5%), IO.Net (2%), Arweave (2%), Aethir (trade)

The DePIN sector experienced significant growth in 2024, with its market cap rising from $20 billion to $50 billion. The total addressable market for DePin is well into the trillions, so as long as the macro environment remains favorable, a 10x growth in 2025 seems realistic to me as established projects emerge, offering services far cheaper than their Web2 competitors.

DePin covers a variety of sectors, so my approach is to focus on the areas where I expect the most demand and find projects with token models where revenue is driven to the token.

If you're unsure what DePin is, check out the first half of my post The DePin Opportunity.

Helium

I began that post using one of the oldest DePin projects, Helium, as an example. At the time I wrote that post, I wasn’t invested in Helium, but it’s now one of the latest additions to my portfolio, having made my final buy today. The token has been sold off which I believe is partly due to the SEC having just filed a lawsuit against Nova Labs, the creators of Helium. Like most of the lawsuits I expect this to be thrown out with the new administration so I’m taking advantage of the suppressed price.

Helium has been a poster child for DePin, being one of the first launched in the space. Helium Mobile’s $20 per-month unlimited plans are considerably less than the average three-figure plans that categorize American telecom.

These Web2 companies are unable to compete with Helium’s price, so I expect 2025 to be a stellar year as they continue onboarding new users. Helium has also simplified its token design and implemented a buyback and burn mechanism to drive value to the token.

GPU/Compute DePins

The second half of The DePin Opportunity focuses on GPU/Compute DePIN projects, and I share my reasons for investing in Nosana, IO.Net, and Aethir.

If you listen to the All In Podcast I linked above it’s mentioned multiple times how they’re expecting a significant demand for compute in 2025 with a lack of supply. I think this narrative alone will result in positive price appreciation for these projects tokens.

GeodNet

My largest DePin holding is GeodNet, which I covered in DePin Opportunity (Part 2) - GEODNET

The price is up 50% since then and it’s starting to gain attention, often mentioned in podcasts, and even by a prominent hedge fund that has announced a recent allocation. As I stated in that post, one of the things I liked is that I was getting in at the same price level as the original backers—something extremely rare for a project as established as GeodNet.

Areweave & AO SuperComputer

Arweave, one of my longest-held positions, was one of my best performers in early 2024, but it’s had a rough last 9 months. I recently learned that part of this decline was due to a whale selling 7% of the total supply.

Arweave is a decentralized storage network with a key differentiator: it provides permanent, tamper-proof data storage at a one-time cost. This space is becoming increasingly competitive, with prominent projects like Walrus launching soon. I’m concerned that Walrus could take market share from Arweave by offering much cheaper storage. While I’ve reduced my position, I still hold 2% because I believe there will always be a market for permanent storage in Web3, ensuring data immutability and longevity.

There’s also big potential for an increase in usage—and thus revenue—through the development of the AO Supercomputer, which leverages Arweave for permanent storage. AO uses Arweave as a foundational layer to securely store data generated and processed on the AO network.

AO is a decentralized supercomputer network designed to provide high-performance compute power for AI, big data, and advanced workloads, using blockchain technology to distribute tasks efficiently and incentivize contributors.

AO is set to launch in February, so the tokens are not yet available on the open market. However, Arweave holders will be airdropped AO tokens. I plan to buy more on launch and will cover AO in more depth in a future post.

Artificial Intelligence

Holdings: TAO (4%), Ai16Z (trade), SNAI (trade)

The AI agent sector began gaining significant traction in late November, driven by a protocol called Virtuals. This protocol enables users to create, trade, and monetize AI agents on blockchain networks. Since its rise, the sector's market cap surged to $16 billion before retracing to $12 billion.

While there’s been considerable speculation—and some criticism—much of the activity so far has centered around AI bots that function similarly to meme coins but with added functionality, as they’re tied to agents like chatbots. For context, the meme coin market cap sits at $130 billion and I’m betting that these AI agents could capture a meaningful share of that market.

However, I believe it’s only a matter of time before we see new innovations, especially as the sector intersects with DeFi. Critics argue that the AI agents being developed in Web2 are far more advanced than their Web3 counterparts. While that may be true, Web2 agents are limited in one critical area: access to finance. Only verified humans can open brokerage accounts or manage funds in traditional systems.

In contrast, Web3 opens up entirely new possibilities by allowing AI agents to operate digital wallets. This could enable agents to trade, manage portfolios, and even execute DeFi strategies on behalf of their token holders. The implications are massive, as these functionalities align perfectly with the decentralized ethos of blockchain.

From my perspective, a $12 billion market cap for the sector seems incredibly undervalued, especially when compared to the $130 billion meme coin market. To gain exposure to this growing sector, I’ve entered short-term trades in Ai16Z and SwarmAI, betting on continued growth over the next six - eight weeks.

Ai16Z is a crypto token powering a decentralized AI ecosystem, designed to fund, develop, and deploy AI models while enabling token holders to benefit from the growth of AI-driven applications

Swarm Node AI (SNAI) is a serverless computing platform for AI agents, providing fast deployment, collaborative data sharing, and scheduling capabilities—much like AWS Lambda but focused solely on decentralized AI, and it’s led by a seasoned developer rapidly expanding his team with a working product already in place

I’m currently conducting more research to decide whether I want to hold any of these—or other projects—longer term. For now, I see this as an emerging sector with immense potential but one I need to better understand before making larger commitments.

Bittensor (TAO)

Bittensor is my largest “AI” holding, accounting for a 4% allocation in my portfolio. Bittensor functions as a global, open-source AI community. Unlike traditional AI systems owned and managed by single entities, Bittensor is fully decentralized, allowing anyone to participate and earn rewards for their contributions.

The network operates through smaller groups called "subnets," each dedicated to specific AI tasks. At the heart of the system is the TAO token, which powers the network by rewarding contributors for their work while ensuring its security and fairness. In essence, Bittensor crowdsources and funds AI development, allowing everyone involved to share in the benefits.

If you’re interested in the technical details, check out this video, however my reasons for investing is simple.

There is growing concern about big tech companies dominating AI development in Web2, given the immense power and influence this technology holds over society. These corporations are locked in an arms race, spending billions of dollars to develop proprietary AI systems within closed ecosystems. This concentration of power raises significant issues around transparency, accountability, and equitable access, as these companies control both the technology and its benefits. Such dominance risks stifling innovation, fostering monopolistic structures, and enabling biased or unethical AI applications that serve corporate interests rather than societal needs.

In my opinion, Europe’s approach of heavy regulation is not the answer to this problem. While well-intentioned, over regulating AI risks stifling progress, allowing adversaries like China and Russia to advance unimpeded and potentially gain a strategic edge in this transformative technology.

This is where Bittensor presents a unique and promising solution. By decentralizing AI development, Bittensor creates an open and collaborative network where no single entity controls the models or data. Instead of relying on centralized tech giants and their closed ecosystems, Bittensor incentivizes individuals and organizations worldwide to contribute computing power and expertise to train AI models.

This decentralized approach ensures a transparent and democratized system where advancements in AI are shared and rewarded fairly using the TAO token. By allowing anyone to participate and collaborate, Bittensor significantly reduces the risk of centralized control over such powerful technology, paving the way for innovation and ethical AI development in a Web3 environment.

What Bittensor aims to achieve is extraordinarily ambitious, but it’s the most promising solution I’ve encountered to address these concerns. If successful, the potential market for becoming the global AI network is enormous, making it a compelling risk-to-reward opportunity in my view.

Decentralised Exchanges (DEX’s)

Holdings = Jupiter (4%), Raydium (4%), Drift (2.5%)

The outlook for Decentralized Finance (DeFi) in 2025 has never been brighter, thanks to the new pro-crypto administration. In recent years, DeFi's growth has been stifled by the Biden administration's anti-crypto stance and SEC Chairman Gary Gensler’s "regulation by enforcement" approach.

Evidence has also emerged supporting what the crypto industry has referred to as Operation Choke Point 2.0—a coordinated effort by U.S. regulators and traditional financial institutions to suppress the DeFi sector by restricting its access to banking services and financial infrastructure. This comes as no surprise, given that traditional banks stand to lose the most if DeFi achieves its full potential.

Marc Andreessen explains Operation Choke Point 2.0 on the JRE podcast.

I now expect the DeFi sector to flourish and am actively on the lookout for new opportunities. For now, my focus remains concentrated on Decentralized Exchanges (DEXs) on Solana.

As I mentioned earlier, Solana is the ecosystem I’m most bullish on. It has become the primary hub for trading memecoins and AI agents, driving significant fees for Solana-based applications like Raydium.

Raydium

At the forefront of this growth is Raydium, which has been generating record fees in recent months and days.

Remarkably, Raydium is currently the most profitable project in all of crypto—excluding the centralized stablecoin issuer Tether. Over the past 12 months, it has generated $5.37 billion in fees, yet it has a fully diluted market cap of only $4.1 billion!

What I find particularly compelling is Raydium’s buyback and burn mechanism, where 12% of the fees generated are used to repurchase and burn its token. I believe this is one of the most efficient ways to return capital to asset holders. As regulatory clarity improves, I expect other DeFi projects to adopt similar mechanisms.

When traditional finance fully enters the crypto space, I anticipate that applications like Raydium will be among the biggest winners. Applying traditional valuation models to a project with such strong fundamentals highlights how significantly undervalued it is today.

Jupiter

Jupiter functions as an aggregator rather than a traditional DEX, making it the go-to platform for most trading activity on Solana due to its superior user interface. Unlike traditional DEXs, Jupiter does not maintain its own liquidity pools. Instead, it aggregates liquidity from various Solana-based DEXs (like Raydium) to identify the best trade routes for users and takes a portion of the fees.

What I find particularly appealing about Jupiter is its strong brand and community, combined with a long-term vision to become the number one exchange for trading Real World Assets (RWAs). As stocks, bonds, commodities, and eventually property become tokenized and traded on-chain, Jupiter is positioning itself to capture this market.

If Solana emerges as the dominant blockchain for tokenized assets, as I expect, then Jupiter is well-positioned to become the leading DEX in this space.

Drift

Drift is a decentralized perpetual futures exchange built for trading perpetual contracts. It offers leveraged trading with advanced features like cross-margining, real-time risk management, and low slippage, making it a standout platform for decentralized derivatives.

With a Fully Diluted Market Cap of just $1 billion, Drift is significantly smaller than Jupiter and Raydium. However, I believe it has the potential to capture substantial market share thanks to its exceptional user interface, innovative features, and the growing demand for decentralized derivatives trading.

As the derivatives market continues to expand within crypto, Drift is well-positioned to become a major player in this space.

What Else?

While I hold several other tokens, I won’t cover them in depth here, as I plan to exit these positions in the near future to focus on concentrating my portfolio. Currently, these holdings include:

SYRUP (2%): The token of Maple Finance, a decentralized credit marketplace bridging the gap between traditional finance and DeFi.

DMT (1%): The utility token powering the Sanko Chain and Dream Machine gaming ecosystem.

CROWN (1%): The native utility token of Photo Finish LIVE, a blockchain-based virtual horse racing game. Players can use it to stake ownership in race tracks, pay for in-game benefits, and earn rewards from successful racing careers.

SCF (0.25%): The Smoking Chicken Fish (SCF) token, a meme coin that serves as the governance token for the decentralized Church of the Smoking Chicken Fish, a legally recognized entity in Texas.

These positions are relatively small in my portfolio, and as I refine my strategy, I intend to consolidate further into my higher-conviction holdings.

What’s on My Watchlist?

I’m actively monitoring the following tokens and protocols, which I believe have significant potential across various sectors of the crypto space:

ZKP: The token for Panther Protocol, a decentralized privacy-enhancing platform for DeFi. Panther leverages zero-knowledge proofs (ZKPs) to allow users to mint fully collateralized zAssets for private and interoperable transactions across multiple blockchains.

GRASS: The native cryptocurrency of the Grass Network, a decentralized platform built on the Solana blockchain and focused on AI development through data collection. GRASS facilitates transactions within the network, rewarding users for sharing unused internet bandwidth. This contributes to the creation of a user-owned knowledge graph of the entire internet.

CLOUD: The native token for Sanctum, a decentralized liquid staking protocol on Solana. Sanctum allows users to stake SOL while maintaining liquidity through liquid staking tokens, which can be utilized across DeFi platforms to unlock additional yield opportunities.

JITO - Jito is an Maximum Extractable Value (MEV)-aware protocol on Solana that optimizes block production, redistributing MEV profits to validators, delegators, and searchers. It enhances network efficiency, boosts validator rewards, and supports decentralization, ensuring a fair and fast ecosystem as Solana scales.

Thanks for reading, and feel free to share.

Super content, SOL & SUI 👀🍾