Visiting NZ, Market Drawdown & What Next

Travel, Markets, The Everything Code, Defi, Zeus Network, & Sui

Travel Update

The Markets

The Everything Code & Where We Stand Today

Adding To Defi

Bitcoin Defi & Zeus Network

Sui & It’s Catalyst

Portfolio Weighting Snapshot & What Next

I left New Zealand in April 2024 to trade financial markets while traveling the world. Crypto is where I’m investing the majority of time, energy and capital. It’s a wild industry that I think is a generational investment opportunity.

I started this Substack after being inspired by a like-minded bloke who documented his journey of ditching the rat race in Australia.

I write about my travels, my portfolio, my trades and where I see the best opportunities in crypto with the objective of making it digestible for a non crypto person looking to learn. Nothing I write is financial advice, I’m simply sharing my journey, thoughts, and trades

After an epic month in Da Nang, Vietnam, I’ve been back in New Zealand for two weeks, with two more to soak up. It’s been a blast reconnecting with family and friends, hopping between Auckland, Taupo, and Hawkes Bay before I head back to Asia in a fortnight.

Despite all my global travels, I’ve yet to find anywhere that rivals NZ’s stunning beauty.

The Markets

Even if you don’t follow markets, you’ve likely caught wind of the past month’s drama. If you’re active and de-risked early this year, hats off—you nailed it. Several analysts I follow called this correction, so I’m sure that there are a few that rode it out safely.

Unfortunately, I’ve been fully deployed since mid-February, with 97% in crypto, much of it in higher-risk projects. My portfolio’s taken a brutal hit as I did not anticipate the depth of this correction.

Despite crypto’s most positive headlines ever, it posted its worst first quarter since 2018—a stark reminder that macro trends drive everything.

Yet, I’m not as rattled as you might expect. I’ve mentally rehearsed this scenario a number of times. My older brother is a crypto skeptic, always urges me to cash out, asking what happens if I’m wrong and it all crashes. That pushes me to play it out: I’m young, no dependents, and there is so much opportunity in today’s world. If it all crashes and burns I’ll just do something else.

I don’t think I’m wrong, though. I’ve weathered drawdowns before and remain bullish for 2025. I’m eyeing this sell-off as a chance to adjust my portfolio into high conviction bets, add some more leverage, and possibly inject more capital if a property sale comes through.

First Quarter 2025 Portfolio Performance (CRYPTO HOLDINGS)

The Orange Man’s Tariffs

I recall reading somewhere that Countries don’t have friends, they only have interests and these events remind me of that.

I like a lot of the Trump administration’s policies, but tariffs rub me the wrong way. They are against free trade, break fair agreements, and thee messy rollout announced with little clarit leaves a sour taste.

I don’t know nearly enough to have a strong view, but from what I’ve read and heard, I lean toward thinking the U.S. might come out ahead despite the chaos.

It’s been fascinating watching it play out. The All In podcast’s latest episode, with Larry Summers and Ezra Klein is definitely worth a watch.

Market-wise, I reckon we’ve seen the worst. I’m betting on rallies in the coming weeks as trade deals take shape. Just look at how markets perked up after the 90-day tariff pause. Buyers are ready to deploy, they’re just waiting for more clarity.

I align with Jordi Vissers’ take in his Substack post (a short read).

Likewise, Raoul Pal and Julian Bitell’s latest update, rooted in their “Everything Code Framework,” fuels my conviction—it’s a lens I’ve covered many times in this publication.

Their first 15 minutes give a solid overview, which I got Grok to summarize here.

Raoul Pal’s Take: The Everything Code and Where We Stand Today

The "Everything Code" framework. The lens used to decode how demographics, debt, and liquidity shape the global economy.

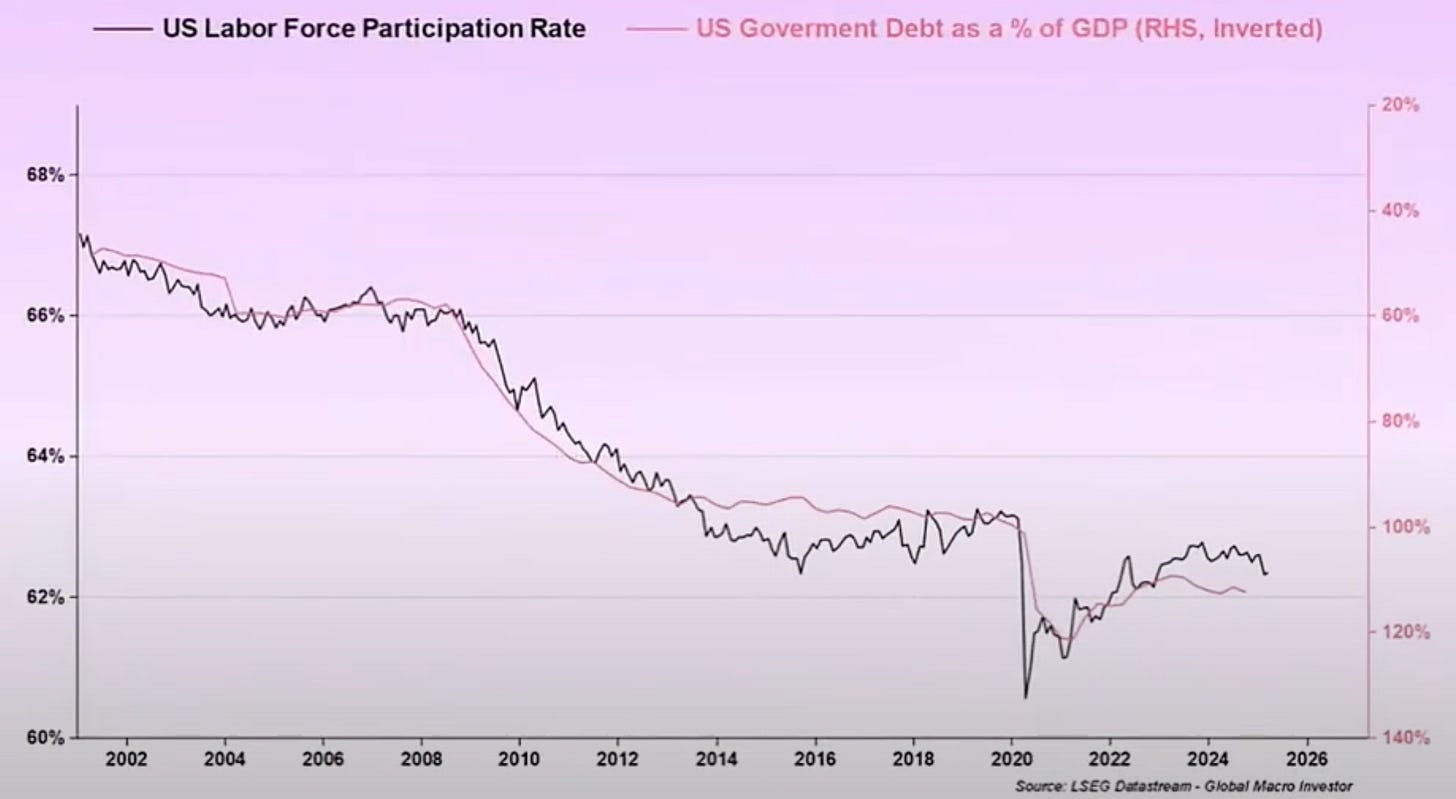

Pal starts with demographics as the bedrock. Aging populations, like those in the U.S., Europe, Japan, and China, drive economic growth, inflation, and government debt. The U.S. fares better than most, but globally, shrinking labor forces drag on GDP. His formula? GDP growth = population growth + productivity growth + debt growth. As populations age and productivity stalls, debt steps in to "paper over the cracks."

[Insert chart here: Debt-to-GDP vs. aging population]

This chart, which Pal calls the "most important in macro," shows debt ballooning as demographics weaken—a trend he says few notice.

To manage this debt spiral, governments and central banks lean on liquidity—aka currency debasement. Since 2008, they’ve evolved from balance sheet expansions (think QE) to "net liquidity" (using tools like reverse repos and Treasury accounts) and now "total liquidity," roping in the banking sector to absorb government bonds.

Pal ties this to rising interest payments, met by liquidity injections—echoing post-WWII financial repression, where yields lag growth to erode debt over time. He sees us 17 years into a similar cycle, with the S&P mirroring the 1950s.

Zooming into today, Pal frames a four-year debt refinancing cycle with "seasons." We’re entering "autumn"—a peak debt-roll period with $9-10 trillion due this year.

Liquidity must rise to meet it, and he expects an expansion soon. Global M2 (money supply) and the dollar’s trajectory are key proxies—forget Fed rate cuts, which he calls a "red herring." Half the world’s debt is in dollars, so global liquidity, not just U.S. policy, matters.

China’s the wildcard. Facing deflation and a dollar debt crunch. It needs a weaker dollar to stimulate without crashing the yuan. Enter Japan: the yen, a major export currency, has been weak, pressuring China’s exporters as the yuan-yen pair tilts too strong.

A strengthening yen and weakening dollar could ease this via the eurodollar market, channeling capital to China and rebalancing trade. Pal predicts a U.S.-China deal—the "Mar-a-Lago Accord"—where tariff spats mask a dollar-easing pact, like 2017’s Shanghai Accord that juiced markets. Pal predicts a deal—call it the "Mar-a-Lago Accord"—where the U.S. and China publicly spar over tariffs but quietly agree to terms that ease dollar strength.

His takeaway? Headlines are noise; the real story is liquidity and financial conditions easing fast. Markets lag these shifts, setting up a bullish turn if China’s headline risk flips positive. It’s a complex web, but Pal’s betting on a rebalancing act that echoes history.

Adding To Defi Holdings

I’ve been cutting positions where my convictions aren’t as strong and doubling down on high-conviction bets, while taking some leverage by borrowing against my large Solana holding.

I think many projects within the DeFi is ripe for buying right now. Most cryptocurrencies are vaporware andmany won’t recover from this sell off and will fade to zero. But DeFi’s different. There are a lot of protocols that generate real revenue, and right now, they’re wildly oversold.

I wrote recently in this newsletter why 2025 could be DeFi’s year, citing better UI, clearer regulations, and on-chain RWAs and AI agents. I was dead wrong on timing, but this sell-off makes the opportunity even juicier—these tailwinds still hold.

While most traders wait for price strength, I find these levels too good to ignore. I’ve been scaling into several DeFi projects. My portfolio holds 10 and it’s Jupiter, Raydium, Kamino, and Sky Finance standing out for their stellar revenue-to-valuation ratios.

Revenue—what’s left after payouts and expenses—is the best gauge of a protocol’s health. You can measure it against market cap or fully diluted valuation (if all tokens were circulating), like a P/E ratio in traditional finance. These four projects scream value, and I’m betting big they’ll shine in 2025.

JUPITER

Jupiter is a decentralized exchange (DEX) aggregator that allows users to swap tokens at optimal prices with low slippage and transaction fees in the Solana ecosystem. It also provides users the optimal routes for direct swaps between multiple exchanges and liquidity pools.

Revenue Last 12 Months = $144.6m

Current Fully Diluted Market Cap (FDMC) = $4.3 billion

FDMC / 12 months Revenue = 29.7

RAYDIUM

Raydium is a Solana-based decentralized exchange that blends an automated market maker with Serum’s order book, offering fast, low-cost token swaps, liquidity pools, yield farming, and IDO launches, with better pricing and less slippage for traders.

Revenue Last 12 Months = $163.1m

Current Fully Diluted Market Cap (FDMC) = $1 billion

FDMC / 12 months Revenue = 6.1

KAMINO

Kamino Finance is a Solana-based DeFi platform that automates lending, liquidity, and leverage through vaults, adjusting risk and collateral for users to earn interest and trading fees passively from concentrated liquidity protocols, simplifying complex strategies.

Revenue Last 12 Months = $23.1m

Current Fully Diluted Market Cap (FDMC) = $498.7m

FDMC / 12 months Revenue = 21.6

SKY FINANCE

Sky Finance, formerly Maker (MKR), is an Ethereum-based platform that lets users borrow its stablecoin DAI by locking up assets like ETH, launched in 2015 to make finance open to all. It’s run by MKR token holders who vote on rules and upgrades, but in 2024, it rebranded to SKY to simplify and grow its reach. Think of it as a decentralized loan system where the community calls the shots.

Protocol Earnings Last 12 Months = $280.6m

Current Fully Diluted Market Cap (FDMC) = $1.4 billion

FDMC / 12 months Earnings = 5

Bitcoin Defi

The biggest crypto gains often come from spotting new narratives early, beyond just chasing numbers. Bitcoin DeFi isn’t new, but it’s unfinished. BTC, the king of crypto, shines as the ultimate store of value and pristine collateral within the industry, yet its design limits functionality.

Countless projects have tried to unlock its liquidity for DeFi—think wrapped versions like WBTC or cbBTC—but they lean on centralized custodians, falling short of trustless ideals.

Billions in idle BTC sit waiting. I’m betting Zeus Network can crack this puzzle, bridging Bitcoin’s security to Solana’s DeFi speed with zBTC, a 1:1 pegged asset that’s fully permissionless.

That’s why I’m building a 3% position in ZEUS tokens.

ZEUS NETWORK

Zeus Network is cross-chain infrastructure built on Solana, empowering developers to create decentralized apps (dApps) that use any crypto asset—regardless of its native blockchain—within Solana’s ecosystem. Unlike competitors, Zeus operates without centralized custodians, offering a trustless edge. Its flagship mission? Unlocking Bitcoin liquidity for Solana DeFi via APOLLO, its first dApp.

APOLLO lets users tap BTC in Solana’s DeFi world securely, yielding returns or borrowing against it without trusted middlemen. This could unleash billions in idle Bitcoin, transforming how holders engage with their assets.

What drives $ZEUS token value? Its utility and network growth hold the key:

Utility:

Staking for Security: Holders delegate $ZEUS to Guardians, bolstering network integrity and earning rewards, like a share of fees or yields.

Governance: Token holders vote on upgrades or protocol tweaks, shaping Zeus to community needs.

Fee Sharing: Cross-chain transactions (e.g., minting zBTC, DeFi trades) generate fees, some redistributed to staked $ZEUS holders as passive income.

Value Drivers:

Demand: If Zeus channels even 1% of Bitcoin’s $1.3 trillion market cap (~$13 billion) to Solana, staking needs spike, lifting $ZEUS demand.

Growth: Unlocking BTC for DeFi—think yield farming or lending—could flood Solana with liquidity, making $ZEUS central to a booming ecosystem.

Scarcity: With only 1 billion $ZEUS tokens, heavy staking could lock up supply, tightening availability as usage grows.

Upside Potential: If Zeus captures a slice of BTC’s liquidity, $ZEUS could anchor a multi-billion-dollar DeFi hub, rewarding early believers like me.

ADDING TO SUI

Another portfolio adjustment is boosting my SUI position. It’s already 13% of my portfolio, and I’m pushing it to 16% - 20%, mostly by trimming some Solana holdings.

I’ve written about Sui before in this newsletter, most recently in My Portfolio Positioning for 2025, highlighting potential catalysts such as the innovative features (ZK Login), Phantom Wallet integration, and accessing BTC liquidity.

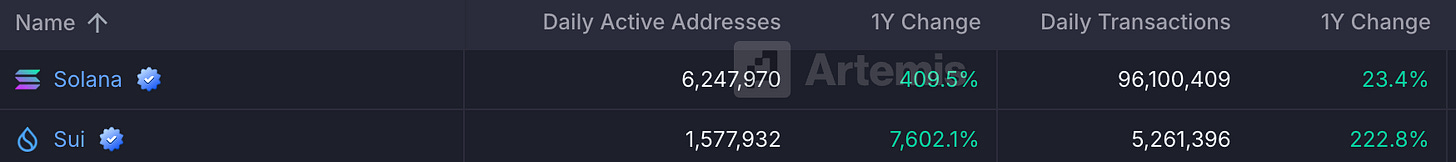

When comparing Solana and Sui’s on chain metrics it’s Solana that stands out as undervalued given it’s dominance in on chain usage.

However it’s the trend of SUI that has me interested and I remind myself that price often outpaces fundamentals in Crypto.

I’m also betting that that there will soon be a huge catalyst for SUI driving on chain usage and that is GAMING.

GAMING ON SUI

Gaming isn’t a fresh narrative. It’s long been hailed as the use case to bring non-crypto folks into the fold. With 3.1 billion gamers worldwide—outspending film and music combined—it’s a colossal market. Yet, most crypto gaming projects have crashed and burned, weighed down by over-financialization and lackluster gameplay. Sui takes a smarter path, building infrastructure so Web2 gaming giants can craft fun, blockchain-enhanced experiences without reinventing the wheel.

Benefits for Players

The heart of any game is fun, blockchain or not. But once blockchain gaming on catches fire, players won’t want to return to Web2, assuming the games are just as fun. Why? They can truly own their avatars and skins, trade them freely, or cash out, all within the game’s universe. Sui’s seamless Google or Facebook login keeps things as easy as Web2, no crypto know-how needed. Once players experience this freedom in games as gripping as Web2’s, they’ll ditch platforms that lock them in.

Benefits for Game Companies/Creators

So, why would Web2 gaming companies pivot from a proven model to build on Sui? The answer lies in economics and opportunity.

Sui slashes costs: no need to build payment systems, app stores, or distribution networks, and no 30% app store tax draining profits. These savings can fund player rewards or lower prices, driving loyalty.

Sui’s blockchain powers secure, low-cost trading of assets like skins, tapping into black markets worth hundreds of millions monthly while curbing scams. Companies can earn a slice of these player-to-player trades, creating revenue without managing sales themselves.

Sui stands out from other blockchains with two key features: ZK Login lets players sign in with Google or Facebook, cutting onboarding hurdles and pulling in bigger crowds, while horizontal scaling keeps fees flat and low, even with millions playing, so costs stay predictable.

By building on Sui, companies don’t lose revenue—they gain efficiency, access new markets, and build deeper player connections.

Partnerships & Upcoming Releases

Sui’s approach is already winning over heavyweights. Partnerships with giants like Sega and top Korean gaming studios—some publicly listed with hundreds of millions of users—signal trust in Sui’s vision. These studios are crafting games that weave blockchain seamlessly into the fun, so players barely notice they’re using it. On the horizon, the SuiPlay ZX1, a handheld console launching summer 2025, will let gamers play while earning rewards via a simple Google login, no crypto jargon required. These moves position Sui to onboard millions, proving gaming can spark massive on-chain activity.

Portfolio Weighting Snapshot

Here’s a look at my portfolio’s current allocations, followed by the target weightings I’m aiming to hit in the coming weeks.

What Next

I’ve got two weeks left in New Zealand, kicking off with a few days in Raglan before reuniting with more family in Taupo and Hawkes Bay. Then it’s back to Asia—likely Bali for two or three months—before eyeing Portugal or Spain, in July. Europe is most likely “market dependant” at this point given the costs compared to asia.

My monthly cash-out averages $5,000 USD. I usually spend less, but I still need to cover property expenses for my three apartments in Auckland. Speaking of which, I’ve got an apartment listed off-market with a couple of potential buyers.

I’m indifferent about it selling because it’s got solid upside over the next two to five years, but I see bigger gains in crypto at today’s prices. If a buyer steps, I’ll sell it to get more crypto exposure.

I will leave you with these two charts.