Positioning for Phase 2 of the Bull!

Back in Bali, cutting some bags, adding others, and going LONG Ethereum!

I left New Zealand in April 2024 to trade Crypto full time while traveling the world.

I started this Substack after being inspired by a like-minded bloke who documented his journey of ditching the rat race in Australia.

Nothing here is financial advice, I’m simply sharing my journey, thoughts, and trades.

Since my last post back in April, I’ve left New Zealand after spending a month there visiting. I spent a week in Guangzhou, China, followed by a couple of weeks in Cambodia for a poker tournament, and now I’m back in Bali, where I’ve been for almost a month.

It’s been a wild ride since I left NZ in April 2024. I took on a lot of risk — and it paid off. I doubled my bankroll over the year and locked in some solid profits, only to re-deploy everything near the top of the market in January… resulting in almost all of those gains vanish over February and March.

My portfolio even tagged my breakeven level at the March lows. But my conviction didn’t waver — I even tried to sell another property to deploy more capital (unsuccessfully). Still, I took on some leverage and managed to add to key positions at the lows.

Since then, we’ve bounced back aggressively. The portfolio is well into the green again, but with the amount of leverage I still have on, I’m definitely not “sitting comfy.”

That said, I’m excited for the months ahead. I believe we’re now entering the second leg of the crypto bull market — a.k.a. the Banana Zone Phase 2. We’ve seen a healthy pullback over the past week, and I think we’re setting up for a face-ripping rally in late June and July.

This outlook is based on the global liquidity picture and the continued mainstream adoption of Bitcoin and crypto. We started this year with some of the most bullish headlines in history — and that’s where I got offside with my positioning. I stepped away from my framework, thinking the correlation with Global M2 would break. But it didn’t. It’s tracked it almost perfectly, while the fundamentals — adoption and regulatory clarity — continue to strengthen.

Will Bitcoin continue to dominate or is it finally alt season?

Bitcoin dominance continues to trend higher and looks set to make a new high in the weeks ahead.

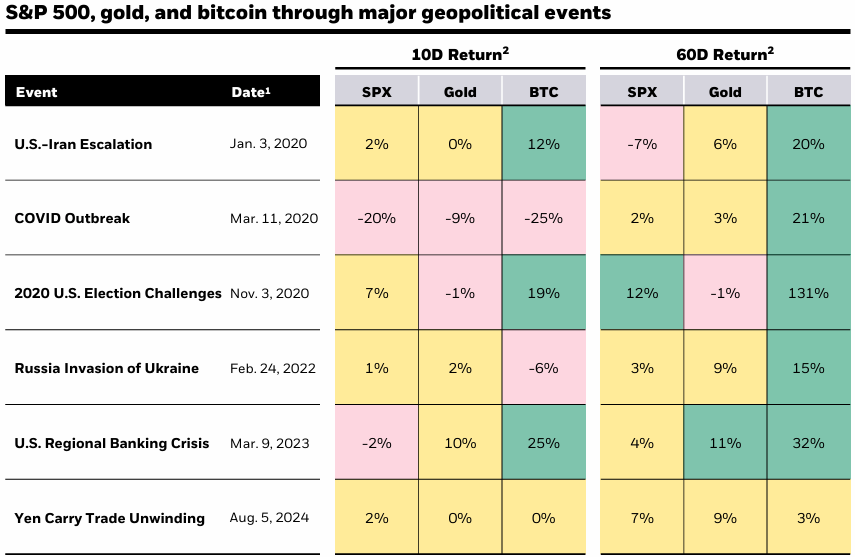

Historically, Bitcoin has traded like a risk-on asset — but that correlation finally seems to be breaking. Bitcoin has matured. Now, big players are buying it not for speculation, but as a place to store value outside the traditional financial system. BlackRock — the provider of the largest BTC ETF — has been emphasizing its role as a hedge against monetary, political, and systemic instability.

I’ve been underallocated to BTC, averaging around a 20% holding over the past year. Like most retail crypto investors, if I’d just gone 100% into BTC and left it alone, I’d be in a much better position.

But despite my bullish outlook on BTC, I’m not rotating out of my altcoins — because I think we’re very close to the part of the cycle where they start to outperform. I’ve held this view for a while, and so far I’ve been wrong. But when alts move, they move fast. It only takes a couple of strong months to make up for the gains I’ve missed from BTC.

The difference with altcoins now, compared to past cycles, is that there are so many more to choose from — but 95% of them are still vapourware. That’s why asset selection is more important than ever.

I covered my portfolio and positioning in my last post, but I’ve since made a few changes based on my short-term outlook.

Solana

Solana and its ecosystem seem to be out of favor at the moment. Despite being the most used chain, it still can’t shake off the “Solana Casino” narrative — with critics pointing out that much of the activity revolves around trading meme coins. As a result, its price action remains closely tied to market appetite for Solana-based memes.

I haven’t sold any of my Solana — it remains my largest position — because I still believe it’s significantly undervalued relative to its competitors. The reality is that crypto doesn’t trade on fundamentals in the short term, so I’m prepared to be patient. I think a Solana ETF will be the catalyst for the next major move higher, and I expect that to come at some point this year.

That said, I did cut my position in JITO — a Solana altcoin that trades like beta to SOL — and also reduced exposure to Jupiter (JUP), the largest DEX on Solana, and DRIFT, a Solana-based futures DEX.

Cut IO.Net

IO.Net is a GPU DePIN network built on Solana. It’s been my worst trade — down around 70% from my average entry. Thankfully, I sized the position small and the loss was limited to just over $3,000.

Adoption metrics have been disappointing, and with significant token unlocks coming over the next few months, I expect sustained sell pressure. I still believe in the long-term potential of the sector, but in the short to medium term, I think there are better bets to make.

Adding to ZEUS

ZEUS Network — which I covered in my last post — has dropped around 40% since then. I’ve been adding small amounts on the way down. My trade idea hasn’t changed: I believe BTC DeFi on Solana will be massive, and ZEUS is the key infrastructure play that enables it.

I expect the narrative to turn once Kamino — the leading lending platform on Solana — integrates ZBTC into their ecosystem. That could be the catalyst for a strong move higher.

It’s a high-risk play, so my allocation is limited to just 2%. With a fully diluted market cap of only $162 million, I think there’s room for this to reach $2 billion — which would be a 13x from here.

Adding to TAO

I covered Bittensor (TAO) at the beginning of the year in this post. It’s currently down 23% year-to-date, but it was one of the tokens that saw the most aggressive recoveries off the lows.

Institutional interest continues to grow, and I believe TAO will be one of the top performers when the market shifts back to risk-on — with the AI sector likely leading the charge.

Technically, the setup looks very bullish, with a large inverse head and shoulders pattern forming. A breakout from here could trigger a significant move higher.

Worth Mentioning: Maple Finance (SYRUP)

One of my longest-held altcoin positions, Maple Finance (SYRUP), has surged over 400% in the past two months and now makes up 5% of my portfolio.

Maple is a decentralized credit marketplace bridging the gap between traditional finance and DeFi. They continue to innovate — recently rolling out BTC DeFi products — and now have over $2 billion in assets under management.

Their goal is to become the leading institutional lender in the space, and they’ve built the infrastructure needed to bring real utility to tokenized assets. I see Maple as one of the strongest real-world asset (RWA) plays in crypto.

LONG ETH

Ethereum is still down over 50% from its 2021 highs and has significantly underperformed in recent years. I rotated a good portion of my ETH into Solana in mid-to-late 2024, which proved to be the right move.

However, ETH is finally catching a bid. It held up impressively well during the recent correction, which often signals strength ahead of a major move. I’m betting it will be one of the top performers in the months to come — but I’m not reallocating capital from my SOL bag, as I still expect Solana to outperform over the full cycle.

So instead, I’ve taken a 10x leveraged long position in ETH perpetual futures, with an average entry at $2,441 and a stop loss at $2,288.

I plan to hold the position until either late August or a price target of $5,800 — whichever comes first.

Reasons for the trade:

Strong recent price performance and bullish technical setup

Sharp Link Gaming announcing plans to build an ETH treasury strategy

Renewed momentum behind Ethereum’s “store of value” narrative

Technical Set Up

ETH is forming a large Inverse Head & Shoulders pattern on the daily timeframe — a classic bullish reversal structure. Price is currently flagging and consolidating just below the neckline, setting the stage for a potential breakout.

Sharp Link Gaming ETH’s treasury

Sharp Link Gaming is the first publicly traded company to announce a strategic treasury allocation to Ethereum. While corporate crypto treasuries are becoming more common, most have focused on Bitcoin — with a few embracing Solana. This move signals growing institutional appetite for ETH, and I believe it sets a precedent that other companies will soon follow.

ETH’s Store of Value Narrative

Ethereum isn’t designed as a high-performance blockchain like Solana or Sui. However, its “store of value” proposition is arguably stronger due to its deflationary mechanisms.

Solana, Sui, and many others are built to scale natively with a monolithic architecture — handling execution, consensus, and data availability all on Layer 1. This design enables them to process tens of thousands of transactions per second with sub-second finality and minimal fees.

Ethereum takes a different, modular approach. Instead of scaling directly on Layer 1, Ethereum functions as a secure settlement layer for a growing ecosystem of Layer 2 solutions like Arbitrum, Optimism, and Base. These Layer 2s execute the majority of transactions, batching and posting results back to Ethereum for final settlement. This allows Ethereum to scale indirectly, preserving decentralization and security.

Layer 2s: A Double-Edged Sword?

One challenge is that Layer 2s now capture most transaction fees and user activity since they handle execution and collect gas fees, only passing a small portion back to Ethereum when posting data. As a result, Ethereum processes fewer transactions directly, which can make its protocol revenue look weaker compared to chains like Solana or Sui that capture all fees on-chain.

Valuing a Smart Contract Platform: Beyond Revenue

Valuation isn’t just about fee revenue. The token’s role in the ecosystem — especially its monetary premium or “store of value” status — matters a lot.

Here, Ethereum stands out.

The Ethereum community argues that ETH has evolved into a form of sound money. This shift began with EIP-1559, which introduced a fee-burning mechanism that reduces ETH supply with every transaction. The Merge then transitioned Ethereum to proof-of-stake, slashing issuance by over 90%.

Under the right conditions, especially during periods of high network activity, the amount of ETH burned can exceed issuance, making ETH deflationary.

This supports ETH’s case as a store of value:

It has credible scarcity, unlike many inflationary tokens on high-performance chains.

It accrues monetary premium as the settlement asset for hundreds of Layer 2s.

It’s deeply integrated into DeFi, staking, and collateral systems, reinforcing demand.

While Ethereum may not be the fastest or cheapest chain, its role as the foundation of a modular ecosystem combined with its deflationary monetary policy gives it a unique and durable position in the smart contract landscape.

ETH’s Past Performance

This story isn’t new. The Merge happened back in September 2022 — right in the middle of a bear market, with the ultimate low hitting two months later. During that tough period, ETH held up relatively well and even outperformed Bitcoin at times.

But by late 2023, Ethereum started to lag behind as Solana grabbed the spotlight. By early 2024, the divergence was unmistakable. While Ethereum’s Layer 2s improved scalability, they also fragmented the ecosystem and captured much of the revenue. Critics argued these L2s were cannibalizing Ethereum’s core value rather than bolstering it.

In late April 2024, the ETH/BTC pair hit lows not seen since 2019 — down nearly 79% against BTC since the Merge. Sentiment on crypto Twitter was bleak, with many declaring Ethereum a “dead chain.”

Yet, just two weeks later, ETH/BTC surged 25% in a week, shaking off that gloom.

Today, investor sentiment is shifting. Ethereum is now viewed as oversold and undervalued rather than obsolete. It still dominates total value locked (TVL) in DeFi, and as traditional finance (TradFi) makes tentative moves into crypto, many see Ethereum as the most likely platform they’ll build on.

I still have larger bets on Solana & Sui

With all that said, my Solana and Sui bags remain bigger because I believe they will outperform over the medium to long term. I place greater value on a smart contract platform’s performance and usability than on the “store of value” narrative around its underlying token.

The true purpose of smart contract platforms is to facilitate the exchange of value. The platforms that do this most efficiently—currently Solana and Sui—are, in my view, best positioned for mass adoption.

That said, the crypto market often trades on narratives rather than fundamentals. Right now, the “store of value” narrative around ETH seems to be gaining traction, so I’m also betting on its outperformance in the months ahead.

Quick Fire

Stablecoin adoption is growing, and besides investing in the layer ones they transact on, I’m exploring other ways to get exposure. Circle’s IPO shows strong investor appetite for this space. There are projects like SKY Finance (which I’m currently holding) and Ethena Labs, both with their own stablecoins, so I plan to dig deeper into these in the coming weeks to see if there’s a trade opportunity.

My visa runs out in Bali in early July, after which I’m heading to the Philippines for another poker festival. I’m down about $5k playing poker this year, but I’ve mostly been in tournaments, which naturally have high variance. I’ve been working on my game—one of my goals this year is to win my first live tournament.

After that, I’ll return to Bali for a couple more months. I’m undecided on what’s next, but Portugal is probably at the top of my list.

I quit alcohol since leaving NZ and won’t touch another drop until I grow my trading bankroll to 1 million NZD.

I’ve also been off caffeine for three weeks, trying to see if it gives me more energy in the evenings. So far, no luck, but supposedly it takes about three weeks for your body to adjust before you start seeing benefits. We’ll see.

I did my first surf lesson recently. I’ve never been a big fan of the water, but the Mrs is a surfer, so I promised to give it a go and see if I can change that.

Solid brother 📈

Great work Mr Smith, and enjoy the surfing, even though I LOVE the water. Where in Bali are you staying? I have a mate, who is also a CS member, basically living in Balian for the surfing and working remotely for his Aussie employer.